All Categories

Featured

Table of Contents

One of the critical aspects of any kind of insurance coverage policy is its cost. IUL policies usually come with numerous charges and costs that can influence their total worth.

However don't simply consider the premium. Pay certain attention to the plan's features which will be essential relying on just how you want to utilize the plan. Talk to an independent life insurance coverage agent who can assist you pick the most effective indexed global life plan for your demands. Complete the life insurance policy application in full.

Review the plan carefully. If adequate, return signed distribution invoices to obtain your global life insurance protection in pressure. Then make your very first costs repayment to trigger your policy. Now that we have actually covered the advantages of IUL, it's vital to recognize exactly how it compares to other life insurance policy plans readily available on the market.

By recognizing the similarities and differences in between these plans, you can make a much more informed choice concerning which kind of life insurance is finest suited for your requirements and financial objectives. We'll start by contrasting index global life with term life insurance, which is commonly thought about the most simple and cost effective type of life insurance coverage.

Indexed Universal Life Insurance

While IUL may provide higher potential returns because of its indexed cash money value growth mechanism, it additionally features higher premiums compared to describe life insurance policy. Both IUL and whole life insurance policy are types of permanent life insurance policies that give death advantage security and cash worth development chances (Indexed Universal Life cash value). However, there are some essential differences in between these 2 sorts of plans that are important to think about when choosing which one is ideal for you.

When considering IUL vs. all other kinds of life insurance policy, it's critical to evaluate the benefits and drawbacks of each plan kind and talk to a seasoned life insurance policy representative or financial adviser to identify the ideal alternative for your special needs and economic goals. While IUL provides many benefits, it's additionally essential to be conscious of the threats and factors to consider related to this kind of life insurance policy policy.

Allow's dive deeper into each of these threats. Among the main issues when thinking about an IUL plan is the various expenses and fees linked with the plan. These can include the expense of insurance policy, policy fees, surrender fees and any extra cyclist costs sustained if you include added benefits to the plan.

Some may use a lot more affordable rates on protection. Inspect the financial investment alternatives available. You want an IUL plan with an array of index fund options to satisfy your requirements. Make certain the life insurance firm straightens with your individual financial goals, requirements, and risk tolerance. An IUL policy need to fit your details situation.

Indexed Universal Life Policyholders

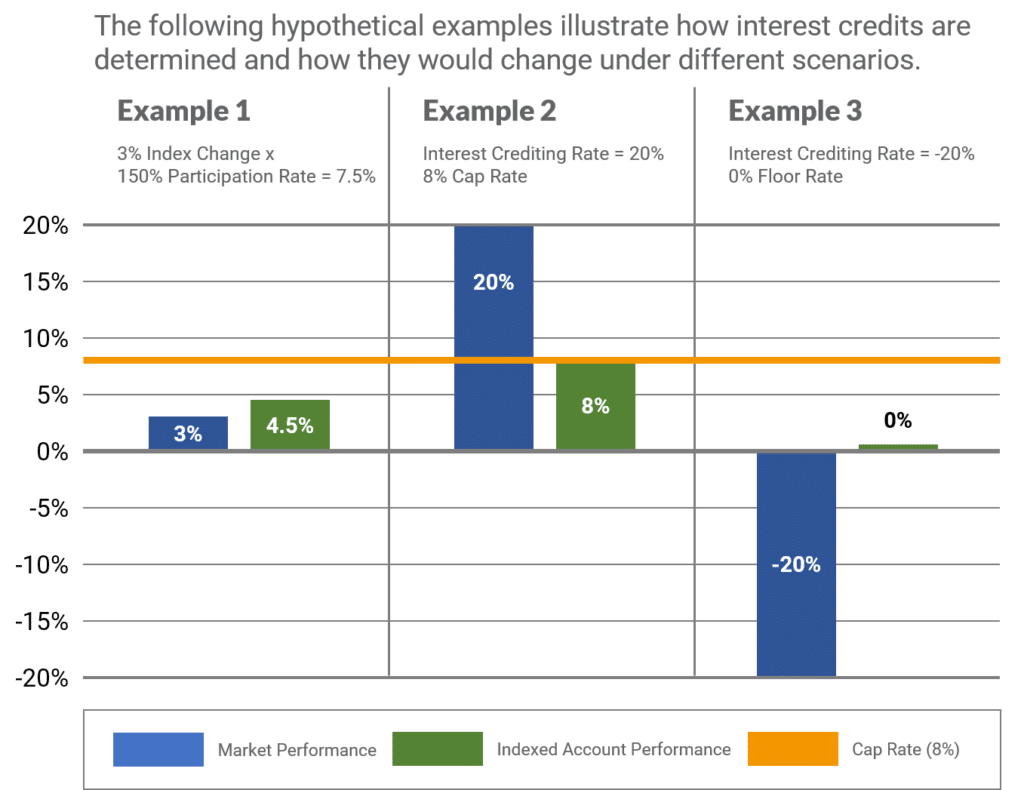

Indexed global life insurance can supply a number of benefits for insurance holders, consisting of versatile costs payments and the possible to earn higher returns. The returns are restricted by caps on gains, and there are no assurances on the market performance. All in all, IUL plans provide a number of potential advantages, but it is important to comprehend their risks.

Life is not worth it for the majority of people. For those looking for predictable lasting financial savings and guaranteed death benefits, whole life may be the much better choice.

What does Long-term Indexed Universal Life Benefits cover?

The advantages of an Indexed Universal Life (IUL) plan include prospective greater returns, no disadvantage threat from market activities, security, versatile payments, no age need, tax-free survivor benefit, and financing schedule. An IUL policy is permanent and supplies cash money worth development with an equity index account. Universal life insurance policy started in 1979 in the United States of America.

By the end of 1983, all major American life insurance firms offered universal life insurance policy. In 1997, the life insurance company, Transamerica, presented indexed global life insurance coverage which provided policyholders the capability to link plan growth with worldwide supply market returns. Today, universal life, or UL as it is additionally understood is available in a selection of various kinds and is a huge part of the life insurance policy market.

The info supplied in this post is for instructional and informational objectives only and must not be understood as financial or financial investment guidance. While the author has experience in the subject, visitors are advised to seek advice from a certified economic advisor prior to making any investment decisions or buying any life insurance policy items.

How do I compare Iul Policyholders plans?

In reality, you might not have actually thought a lot about just how you want to invest your retirement years, though you possibly recognize that you don't wish to run out of cash and you would certainly such as to maintain your current lifestyle. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text appears next to business man talking to the video camera that reviews "business pension", "social protection" and "financial savings"./ wp-end-tag > In the past, individuals relied on 3 main incomes in their retirement: a firm pension plan, Social Protection and whatever they would certainly managed to save

Less companies are supplying typical pension strategies. Also if advantages have not been reduced by the time you retire, Social Safety and security alone was never meant to be enough to pay for the way of life you want and are worthy of.

Before committing to indexed global life insurance coverage, below are some advantages and disadvantages to think about. If you choose a great indexed global life insurance policy plan, you might see your cash value grow in worth. This is valuable due to the fact that you might have the ability to access this money before the strategy expires.

What should I know before getting Indexed Universal Life?

If you can access it early on, it might be useful to factor it into your. Given that indexed universal life insurance policy requires a specific degree of risk, insurance provider tend to keep 6. This sort of strategy also offers. It is still assured, and you can adjust the face amount and cyclists over time7.

Last but not least, if the selected index doesn't perform well, your cash value's growth will be influenced. Typically, the insurance policy company has a vested rate of interest in carrying out better than the index11. There is generally an assured minimum passion rate, so your plan's development will not fall below a particular percentage12. These are all elements to be considered when choosing the very best kind of life insurance policy for you.

However, because this kind of policy is a lot more complicated and has an investment component, it can usually come with higher costs than other policies like entire life or term life insurance - IUL death benefit. If you do not believe indexed global life insurance policy is appropriate for you, below are some alternatives to take into consideration: Term life insurance policy is a short-term policy that commonly offers coverage for 10 to 30 years

Latest Posts

No Lapse Guarantee Universal Life Insurance

Universal Life Insurance Single Premium

Max Funded Indexed Universal Life Insurance